Conventional mortgages are the most popular form of home financing for buyers in the United States. However, it may not always be clear how these loans differ from other loans, such as those provided by government agencies. To help you gain a better understanding of conventional loan basics, here is a quick guide with further information:

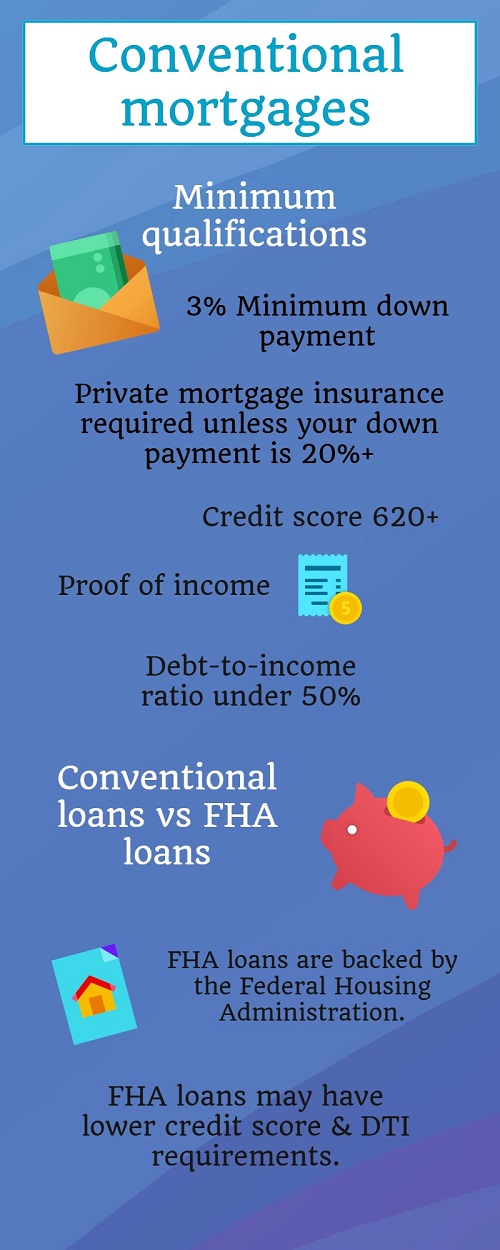

When obtaining conventional financing, your lender will examine your financial situation. The loan officer may request information including your credit score, income statements and debt to income ratios.

A down payment is required for conventional loans. Each lender has different minimum requirements, but the larger the down payment, the less money you’ll have to pay back over time.

Many believe a 20% down payment is required for conventional loans, but the minimum requirement is typically much lower. You can find mortgages with minimum down payment requirements anywhere from 3% to 20% of the overall purchase price.

Your choice of down payment amount can affect the terms of your mortgage, like interest rate or the need for private mortgage insurance.

Government-backed home loans have specific features to suit some homebuyers.

The Federal Housing Administration (FHA) is a government institution offering home loans for buyers who meet certain qualifications. Government-backed loans have advantages for those with bad credit or other financial roadblocks, but require other qualifications for approval.

Conventional mortgages tend to have higher interest rates than FHA loans, although these loans typically require borrowers to pay mortgage-insurance premiums.

Interest rates charged on a conventional mortgage vary by several factors, including the term and amount borrowed. However, interest rates are also subject to change every year based on the overall economy. Many buyers choose to wait for a period when interest rates are lower to apply for a mortgage, regardless of the loan type.

Ultimately, your choice of loan will depend on your personal circumstances. The more you know about different types of mortgage, the better equipped you’ll be for your journey into thefinancial real estate marketplace.

Meet Norma, a trusted realtor in Middle Tennessee. With over 20 years of experience living in Smyrna with her husband and two children, she has a deep understanding of the local community. Norma's background in customer service and the medical field has given her the skills to provide excellent care and service to her clients, no matter the price point of their home.

With a passion for service and a commitment to professionalism, Norma strives to make each client's experience smooth and memorable. As a real estate agent, her first priority is education, as she listens to her clients' needs and wants and uses her skills and 10+ years of experience to deliver a stress-free and enjoyable home buying or selling experience.

Norma is dedicated to making a life-changing difference in her clients' lives and is committed to providing the highest level of service. Let Norma help you navigate the exciting journey of buying or selling your home.